Debt Recovery Services

Debt Recovery Services

We provide a debt recovery service which is tailored to meet your individual requirements. We can help whether you are a sole trader, partnership or limited company of any size. It matters not if your problem relates to a one-off small debt or large on-going bulk debts. For undisputed debts we offer an unrivalled cheap, cost effective, efficient and personal service.

You will be given progress updates on a regular basis from our debt recovery department and recoveries are made in a legal and professional manner. If it becomes defended we will let you know immediately and we will discuss what options are available to you.

-

1.Financial Debt Recovery -

As debt collection specialists, we’ve heard most of the excuses businesses make when they fail to pay a bill. We know how to respond to this and how to exert the right level of pressure to maximise revenue collection.

-

2.Asset Recovery -

We are the leading provider of asset recovery and remarketing services in the United States. Our team has more than a decade of experience in the secure repossessions

-

3.Leased Vehicle Recovery -

We are pioneer in settling and recovering leased vehicles. FSL has recovered a 3000+ leased vehicles all over Pakistan. FSL has provided recovery services to every bank existing in Pakistan for Leased Vehicle Recovery Services.

-

4.Non-Performing / Stuckup Loan Recovery-

FSL master in recovering NPLs . Commercial loans are considered nonperforming if the debtor has made zero payments of interest or principal within 90 days, or is 90 days past due. For a consumer loan, 180 days past due classifies it as an NPL.

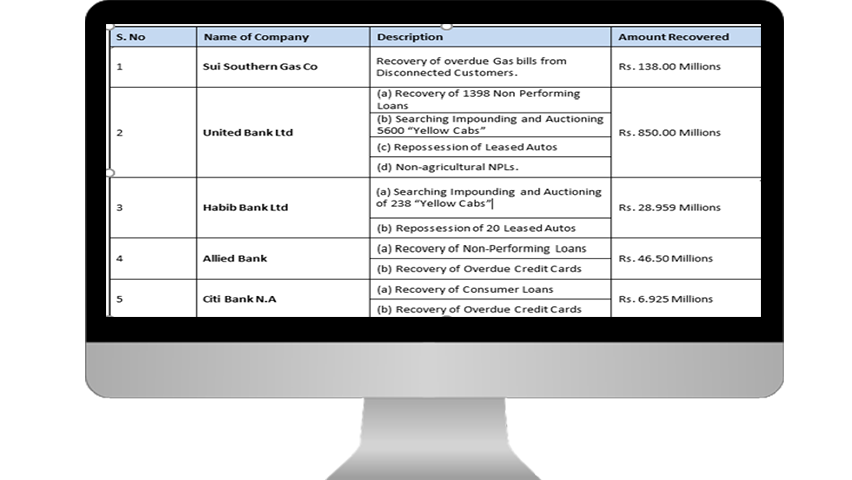

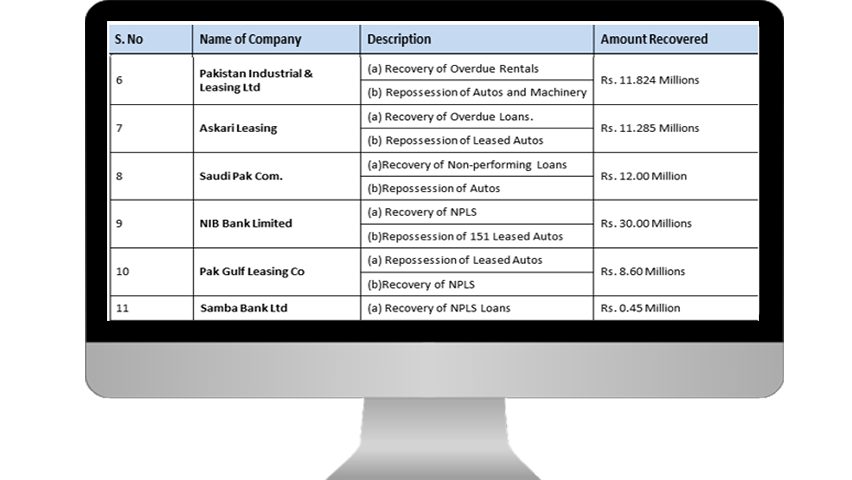

Receivable Management & Debt Collection Portfolio:

FSL RECOVERY METHODOLOGY (FRM)

01: Plan

Preparation of Project Plan and Strategy to attempt the defaulter in a way to bring him to negotiation table. Most importantly identification of available resources that can be helpful in recovery course.

02: Analyze

Conducting analysis of value of debt, performing costing that will be engaged to carry out recovery operation. At the end consolidating all available financial and physical resources for execution of recovery attempt.

03: Attempting the Recovery:

Execution of recovery by creating contact with the defaulter and moving the stone to bring the defaulter at the negotiation table. Just in case if required the guarantor is also approached.

04: Recover

Setting up payment methods and schedule with the defaulter. Indicating crystal clear norms in case not paid. Recovery is made by ensuring resolution of dispute among the parties.

05: Deliver

A complete project documentation is conduction during entire stages of recovery. At the end all project documents are officially handed over to client for further references.

Making Debt an Asset

Debt collection is basically a negotiation settlement to recover the outstanding debt of the

creditor/client(s) through correspondence with the default company. The negotiation for the recovery

of the outstanding debt is done through our own modus operandi followed by the recovery of the

debt. In debt collection, we strive to get the unpaid dues of the company or an individual settled out

of court in an amicable way.

In our Debt Recovery Department, we employ a wide variety of collection practices which have been

established over the years allowing us not only to ensure a fully inclusive collection strategy which is

efficient and effective but also a guarantee of Debt Recovery.

As a marker leader FSL has leaves its impression as corporate Debt Recovery Company which is the first choice of every banking, financial and utility institution. FSL has bagged some big names in its portfolio such as K-Electric, Sui Southern Gas Company, Careem Networks, AF.Fergusons, Habib Bank Limited , United Bank Limited and the list moves on.

© 2019 F.S Services Private Limited | All Rights Reserved FSL